You’ve decided to use Salesforce Financial Services Cloud, a Salesforce CRM built specifically for the financial services industry, but you may not know where to begin. How can you utilize Salesforce to track all your customer interactions and give the best advice for your customers’ specific needs? Whether you're an insurance company, a bank, or an investment company, Salesforce Financial Service Cloud (FSC) is the platform for you.

With a plethora of features, Financial Services Cloud makes sure that you spend less time gathering data and more time focusing on your customer relationships. Salesforce FSC comes with pre-constructed data models that help you track your prospects and clients and allow you to build customized models to better fit your company’s niche. On top of that, FSC promotes automation so that each task is done consistently, effectively, and securely. In this comprehensive guide to FSC, we will go over some of the great features that FSC has to offer and how you can start your journey toward a successful implementation that will meet the specific requirements of your organization.

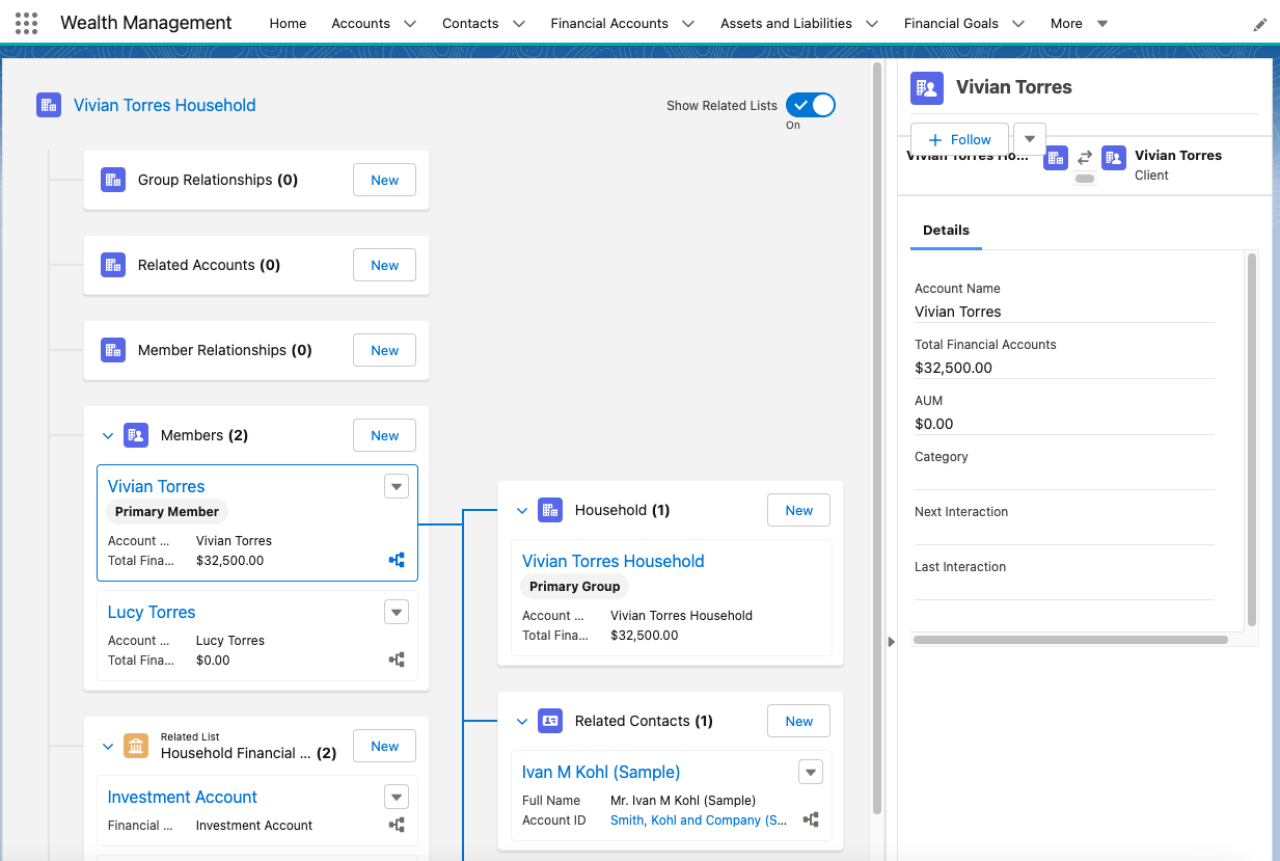

Groups (Householding)

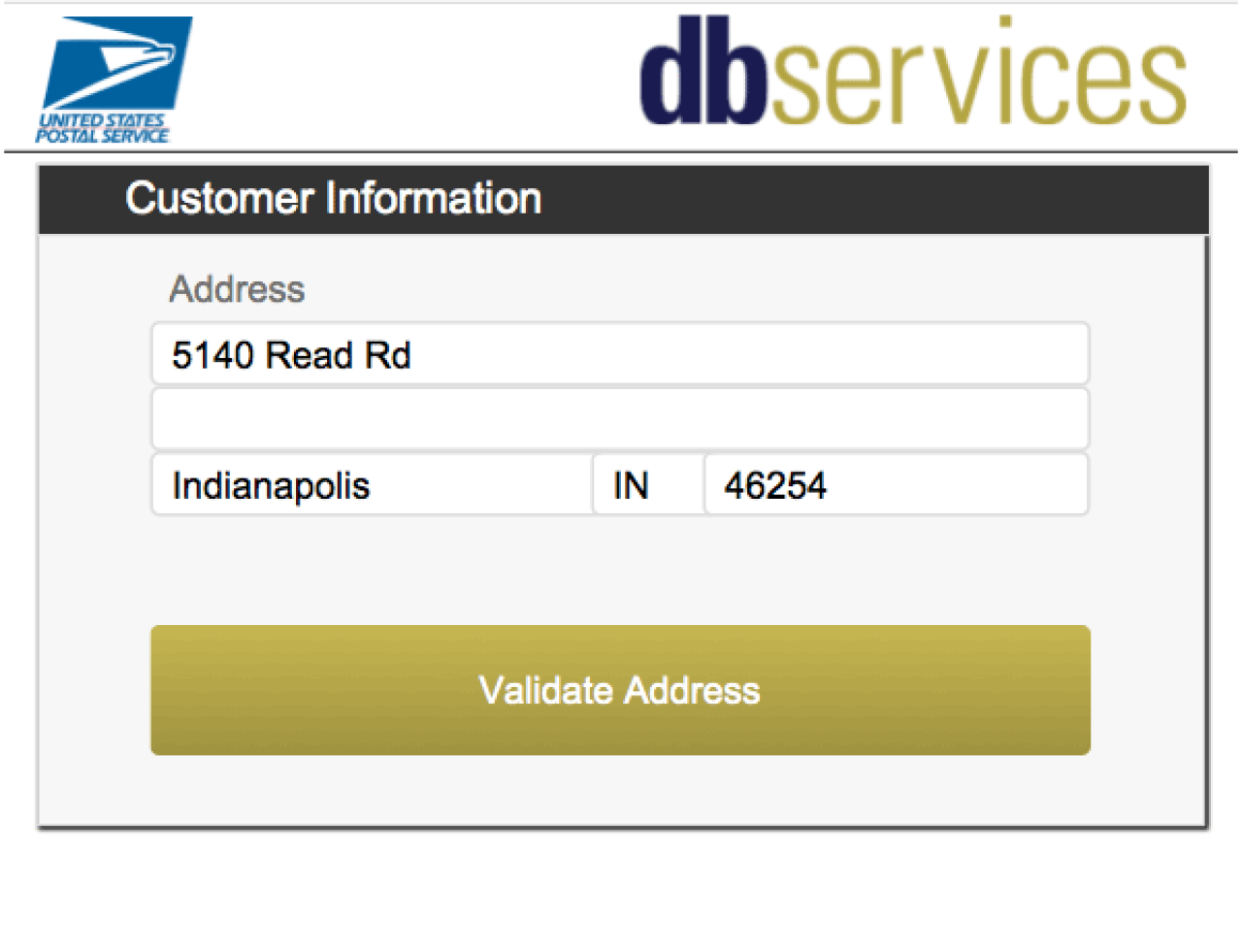

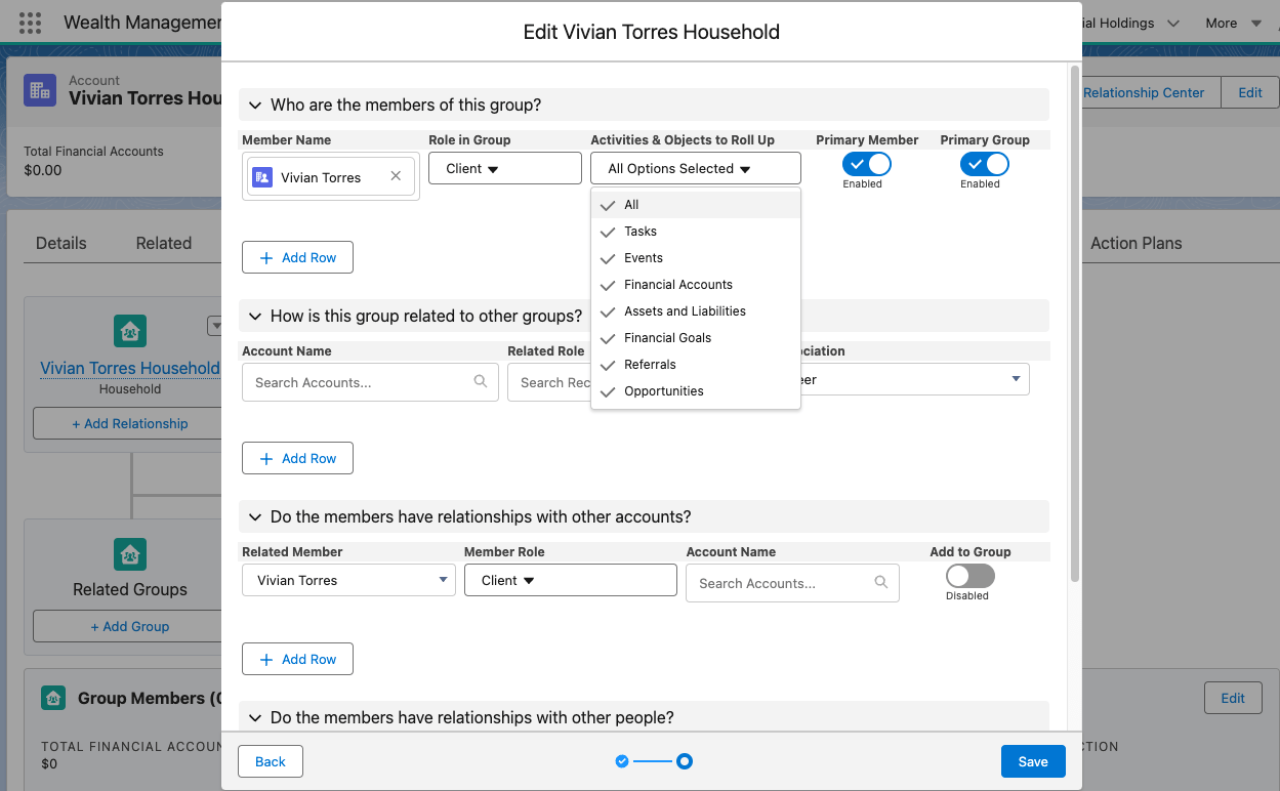

Grouping, or Householding, is useful for gaining insight into a customer’s financial circles, such as their family or professional connections. Individuals can be added to multiple groups as either direct members, such as a spouse, or indirect members, such as the family’s lawyer. Once a household has been created, each member’s financial accounts, activities, and goals can be selectively rolled up and summarized for the group.

When creating households, ask yourself what types of relationships you want to see. Do you want to add your client’s kids? If the client’s spouse is also a client with other relationships, should they have a separate household? Remember to consider the indirect members of a household. Adding the family lawyer, a trust, or even another household can help you get the full picture of the household’s relationships and, in turn, improve operational efficiency.

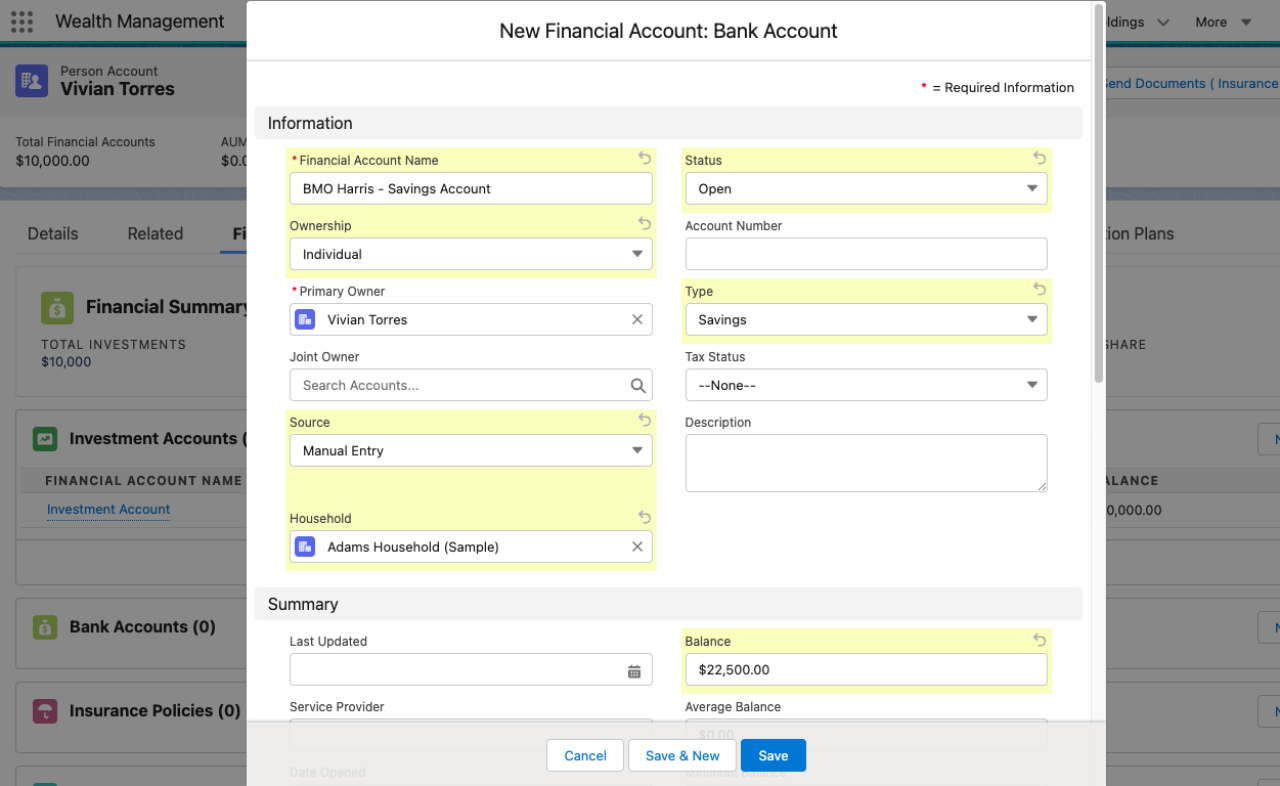

Financial Accounts

Financial accounts are any accounts managed by financial institutions. There are a plethora of supported financial accounts, such as checking accounts, savings accounts, insurance policies, and 401(k) accounts. Once a financial account is created, its information can be rolled up to the primary account owner and the primary household they are a part of.

Think about what types of accounts you want to track. Does your client have a trust fund? Do they have any assets or liabilities? Are any of these accounts held away? Even if the financial account is not managed by you, you can still add it as a ‘Held Away’ financial account. This allows you to see the total financial amount for a customer or household and what percentage of the finances are under your company’s management.

ARC

Actionable Relationship Center (ARC) enables you to better understand and navigate relationships between people and businesses. To see the ARC view of a household account, go to the account page and click on the ‘Open Relationship Center’ button. In the ARC view, you can see the root record that you opened the ARC view from, as well as related groups, accounts, and household members. You can also add new relationships from ARC view and perform quick actions when you select a record. Even though each member shows their total financial amount in the ARC view, you can toggle related lists so that you can see the individual financial accounts, opportunities, and liabilities connected to the household or customer.

You also have the option to customize ARC views. When doing so, consider what data you want to see. Do you want to see related accounts? Should all opportunities and cases be visible, or just the open ones? What sort of actions should users be able to perform on these objects in the ARC view? With the right build, the ARC view can be your one-stop shop for managing your clients.

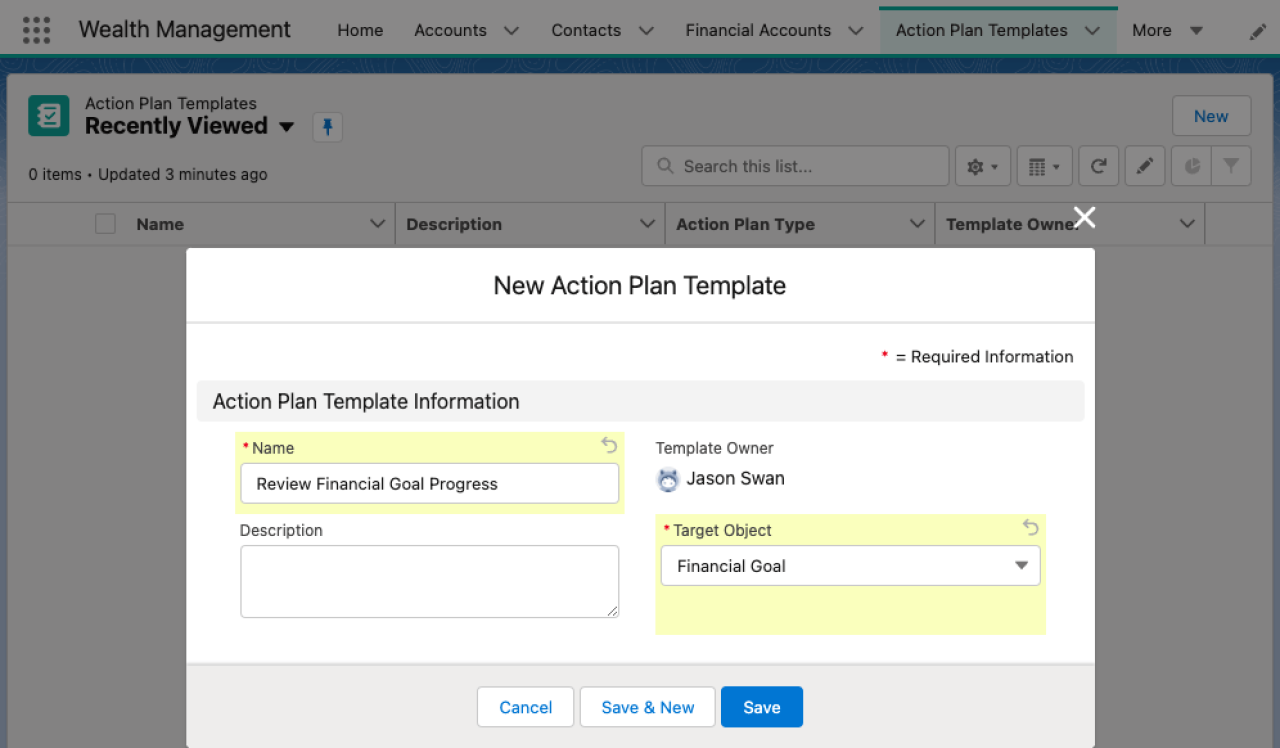

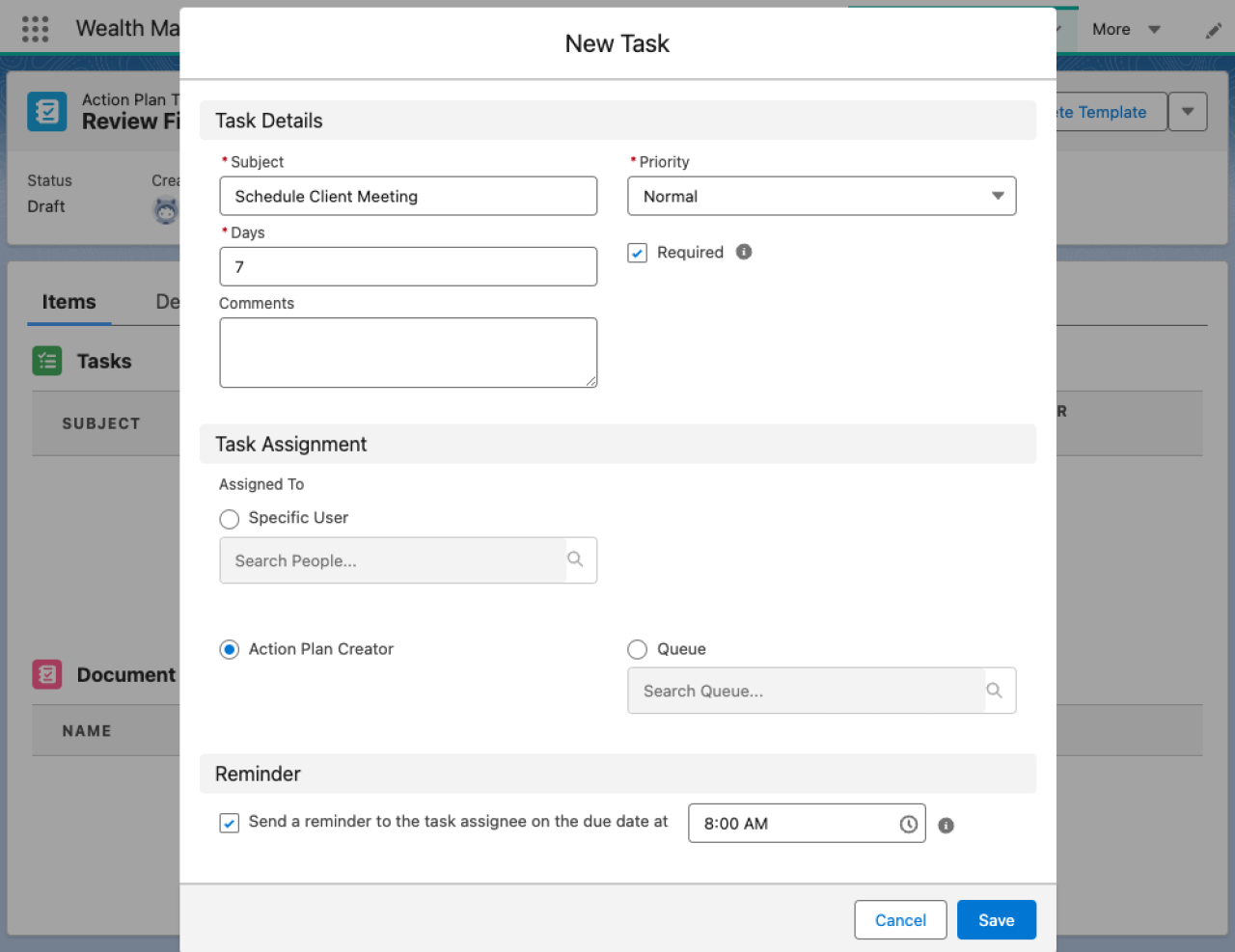

Action Plans and Document Checklist Items

When you have a lot of customers in your system, it can be challenging to ensure that each task for each client is performed timely and properly. Action plans can improve collaboration and productivity by capturing repeatable tasks, such as onboarding financial accounts and resolving cases, and then automating the task sequence. In order to make an action plan, you first have to make an action plan template. An action template is a record of the repeatable tasks that an action plan must follow.

When creating an action template, such as for financial goal meetings with customers, it is important to consider what tasks need to be completed before the event, the order in which these tasks need to be completed, which employees have to do the tasks, and what time these tasks should be completed. Having an answer for each of these will help you build an action plan template that guarantees orderly and punctual preparation for the actions your company has to take. Furthermore, it is important to update an action plan template over time when the prerequisites to an event are better understood.

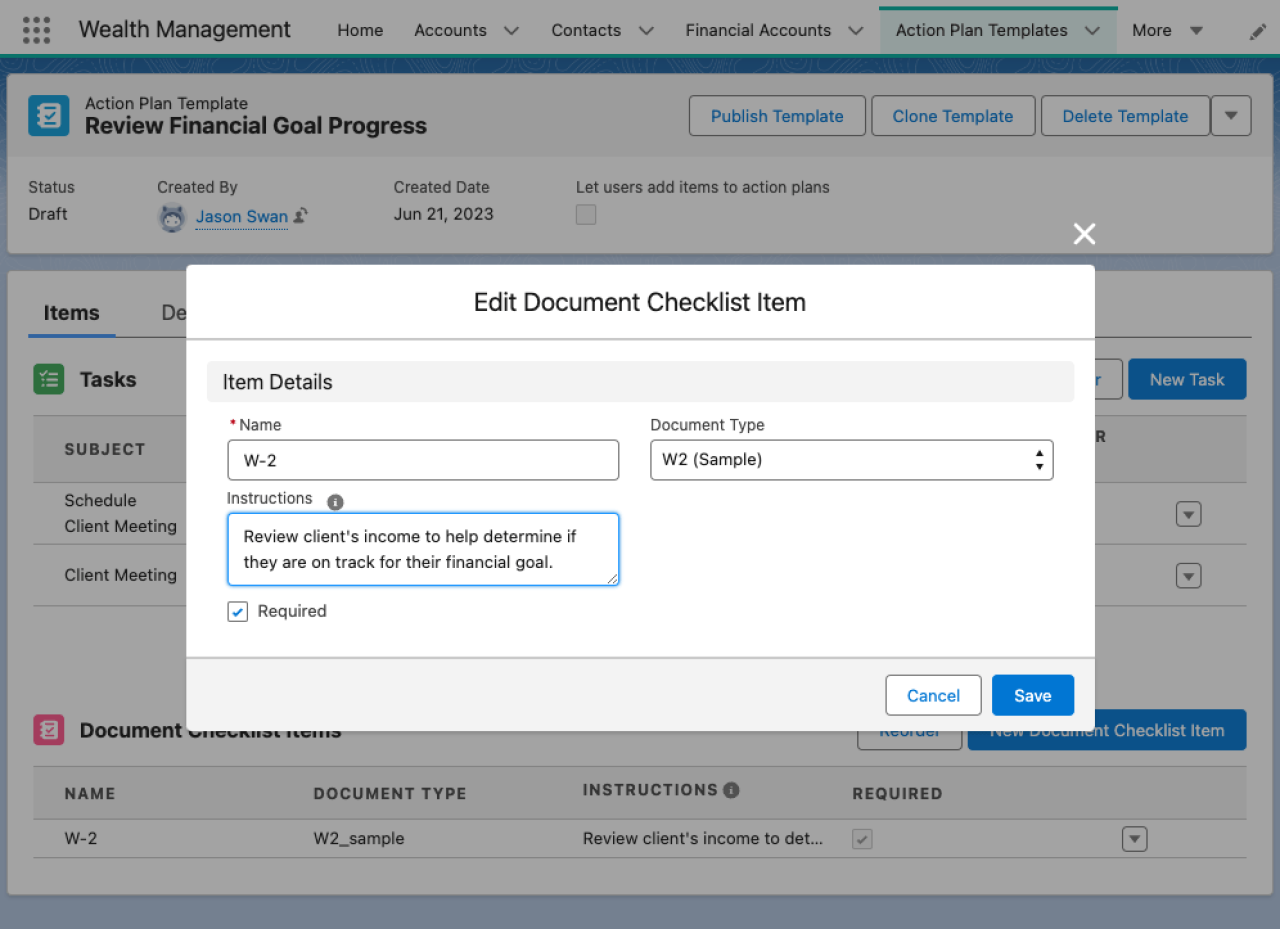

Once you have created an action plan template, you can start adding tasks that have to be completed. Tasks can be given due dates, reminder notifications, and can be assigned to individuals, queues, or the action plan creator. When there are multiple tasks in the action plan template, you can make tasks optional, choose the order of completion, make tasks dependent on the completion of other tasks, and set reminder notifications.

The action plan template is not just limited to a set of tasks. You can also include a list of items that would aid in completing the action plan by adding those items to the document checklist of the template. While optional, it is important to add instructions for each document, as instructions can help one understand why a document is needed and when a document has been sufficiently put together.

Reporting and Dashboards

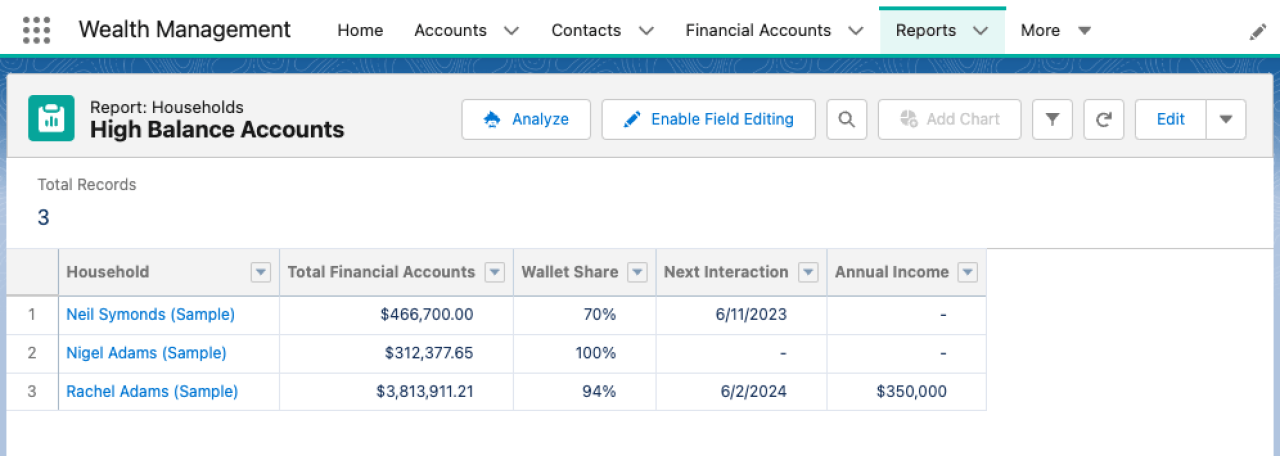

In order to better understand the needs of your customers, it is important to utilize the reports and dashboards of Salesforce. Reports show a list of records that meet your filter criteria, such as households with a total financial accounts balance over $100,000 or accounts that have employees.

Reports

When creating reports, consider why you are making the report, who will be seeing it, and what information they need from it. While more client data in a report can help you get a fuller image of your client, too much data can obfuscate the purpose of the report. With these in mind, you can build reports that illuminate trends with your customers, allowing you to provide a better customer experience.

Dashboards

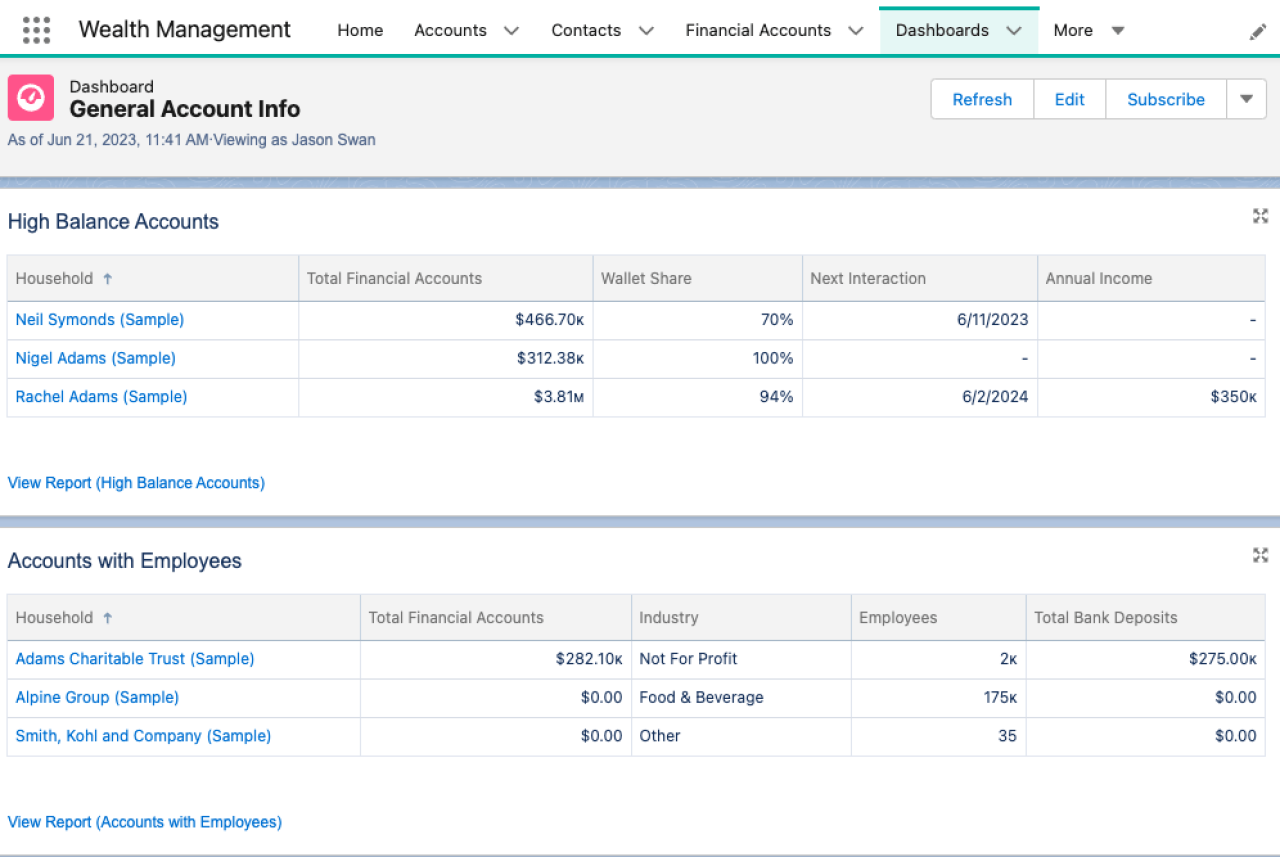

Dashboards take reports and provide a quick look at their data and trends Another great feature of dashboards are dashboard components. If there is a specific set of data that is used in multiple dashboards, consider turning that data into a dashboard component so that it provides a consistent look that can be conveniently updated everywhere at once, rather than having to update each instance of the data individually.

Like with reports, consider the purpose of the dashboard that you are making. Who will be using the dashboard? What sort of information will they be looking for? What is the best format to show the data that the dashboard is using? If there is a need for reports or charts to be available on certain pages of your organization, dashboards make that data readily accessible.

Integrations

Salesforce allows you to integrate with external banking systems using the FSC Integrations API, which enables your org to retrieve real-time data like financial account information and customer address updates. Salesforce also offers an integration app. Since the app is built based off of the Banking Industry Architecture Network (BIAN) canonical model, integration is quick and easy. The FSC integration app is available for download on MuleSoft.

However, if you plan on using the FSC Integrations API, there are a couple of things to keep in mind. What data systems can be used to communicate with your API? Will you be using middleware for your API? What format does your data need to be in and what schema will you be using? Do any use limits need to be set? Nevertheless, implementing the FSC Integration API will provide interoperability that allows data, like balances and transactions, to be shared and updated in a heartbeat.

Security

Salesforce provides the Compliant Data Sharing feature, which lets admins and compliance managers create data-sharing rules to improve regulatory compliance with data security regulations and company policies. Compliant Data Sharing also monitors what data gets shared with whom, which can help identify security issues. Standard objects of this feature include Account Participant and Opportunity Participant, which determine the access level that users have to accounts and opportunities.

For instance, an account manager participant can be given read and edit access to accounts, while an associate participant can be given only read access. Financial Services Cloud also includes additional objects: Interaction Participants, Financial Deal Participants, and Interaction Summary Participants.

There may be a lot to set up, but there is no need to worry. Salesforce offers a guided setup for Compliant Data Sharing.

For your organization's security, ask yourself the following questions. What type of data do you have in your organization? Who needs access to that data, and what kind of access do they need? What are the company policies and security regulations that have to be followed? If your company has confidential details or sensitive financial data that should be private, rest assured that setting up Compliant Data Sharing will make sure that only the right people have access to that information.

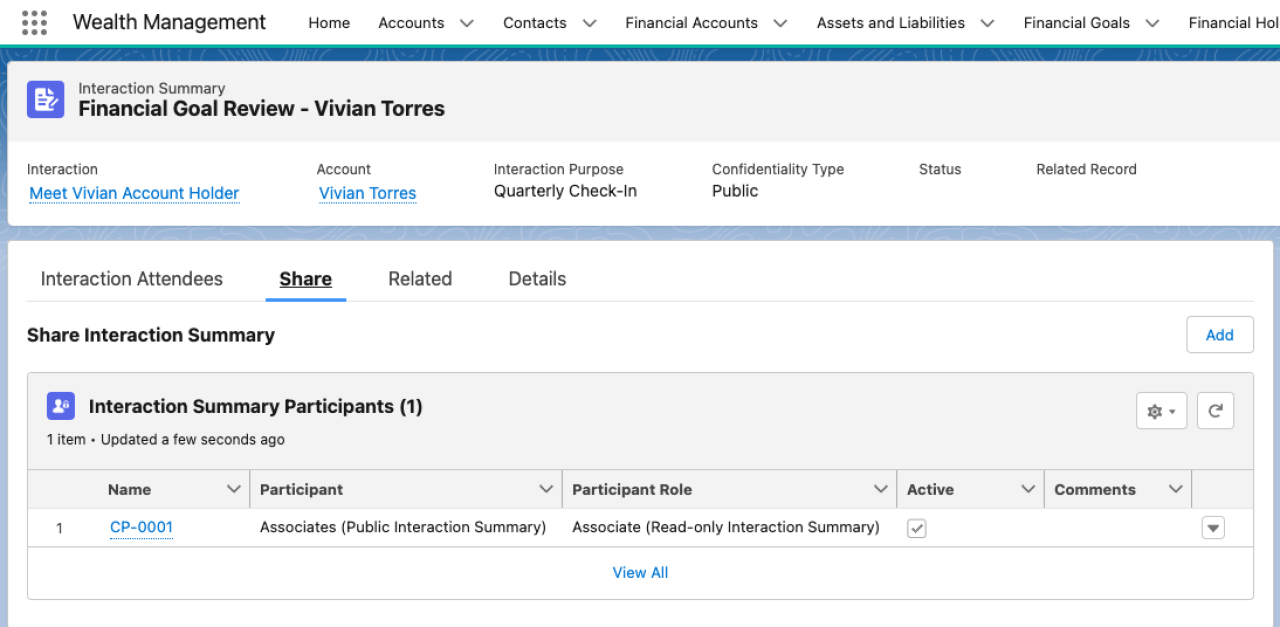

Interaction Summaries

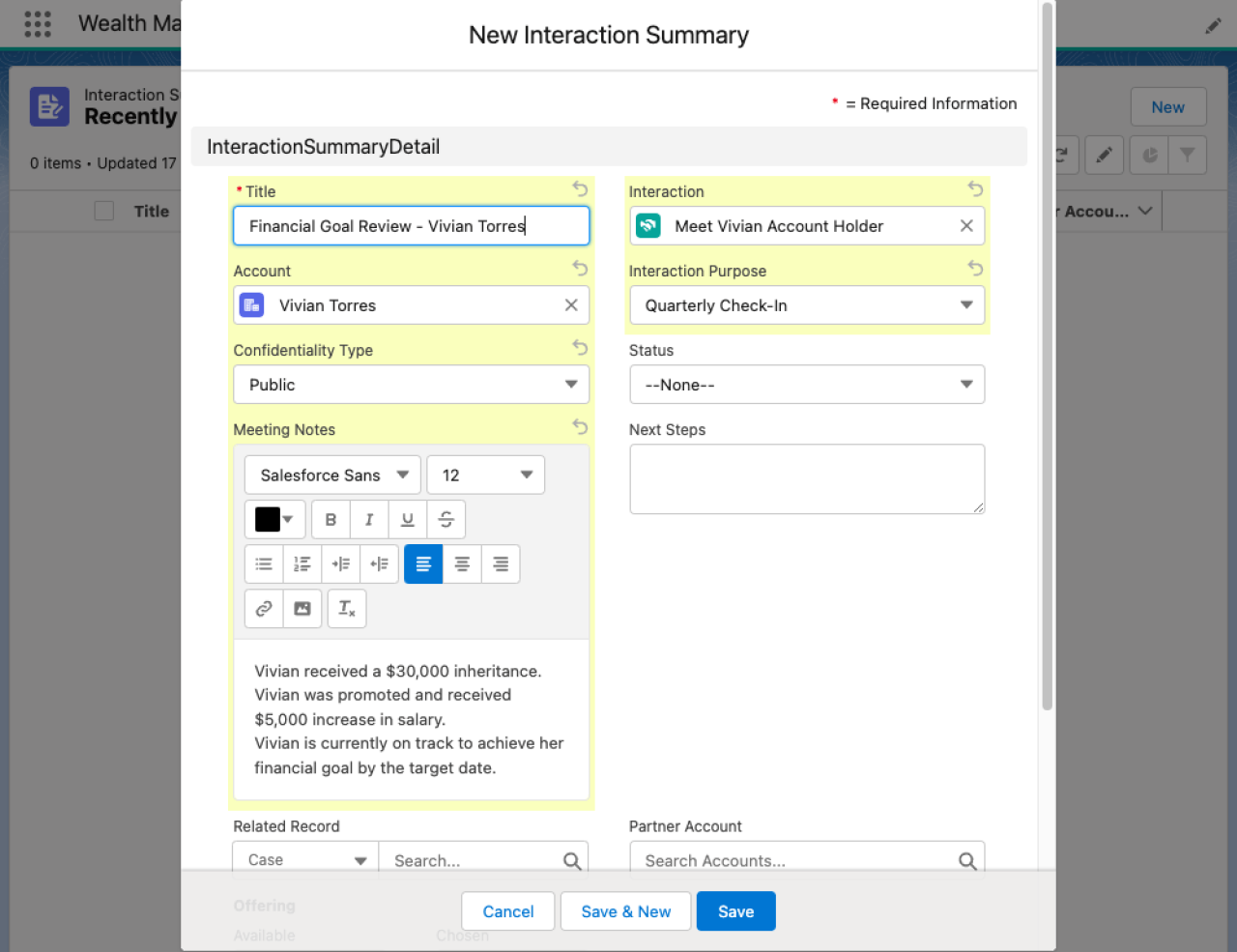

If you are having trouble keeping track of all the details provided by customers, there is no need to fear. When interacting with a customer, the interaction summary can be used to record a variety of relevant information, such as meeting notes, meeting attendees, accounts, dates, forms of communication, and attached documents.

When building an interaction summary, consider the purpose of the interaction, its keynotes, and the next steps based on that interaction. With these in mind, interaction summaries will be useful tools for recording customer interactions.

Interaction summaries can also be shared with other team members. Since the Compliant Data Sharing feature provides interaction summary participants, meeting notes can be shared with select users while maintaining confidentiality. When you consider who should see the summary and what level of access they should have, you’ll make sure that the right people are aware of interactions with a customer and what to do next, improving your relationships and customer satisfaction.

Add-Ons

Salesforce offers a variety of products that can expand Financial Services Cloud, such as Experience Cloud and CRM Analytics. Experience Cloud can be used to create sites that provide external users, like customers or partners, with access to Financial Services Cloud. Salesforce provides site templates, but each site is fully customizable, allowing you to build sites based on the needs of your users. Customizations include page variations, permission sets, and self-guided FAQ articles.

Experience Cloud

Before creating an Experience Cloud site, think about what you want the site to accomplish. What does your site need in order to function? Should you select a Salesforce template with immediate functionality, or should you build a custom site specifically for your company’s needs? Who will be on the site? What objects do you have to enable from Salesforce for the site? What restrictions do you have to put on the site? Can pages from your organization be placed on a site page, or would Lightning Web Components be a better choice? There is a lot to consider, but when done right, an Experience Cloud site can improve a customer’s engagement with your organization.

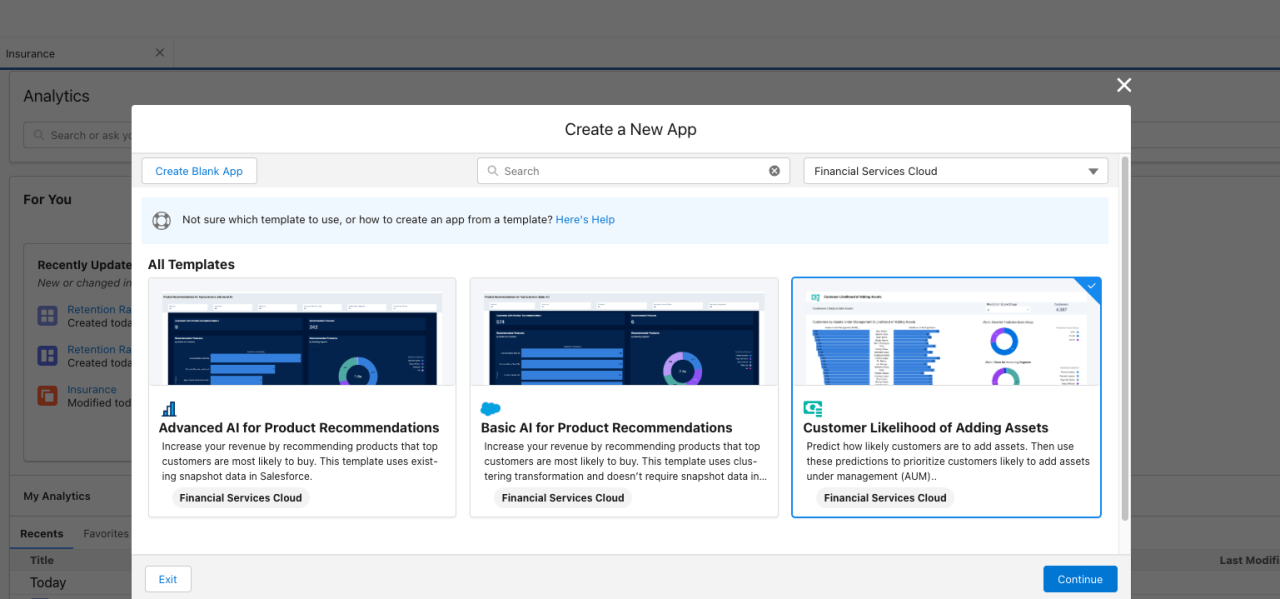

CRM Analytics

CRM Analytics provides a wide range of CRM solutions. On top of using your reports, dashboards, and template apps for Financial Services Cloud, CRM Analytics also uses Einstein Discovery to create automated AI models of any dataset without needing to write any code.

When using CRM Analytics, there are many aspects to plan before creating anything. Once again, consider why you are making an analytics report, dashboard, or app. Who will be using it? What data do they need to get the most use out of what you are building? Good planning reduces the amount of time spent reworking, which means more time focusing on the data and the conclusions that can be drawn from it.

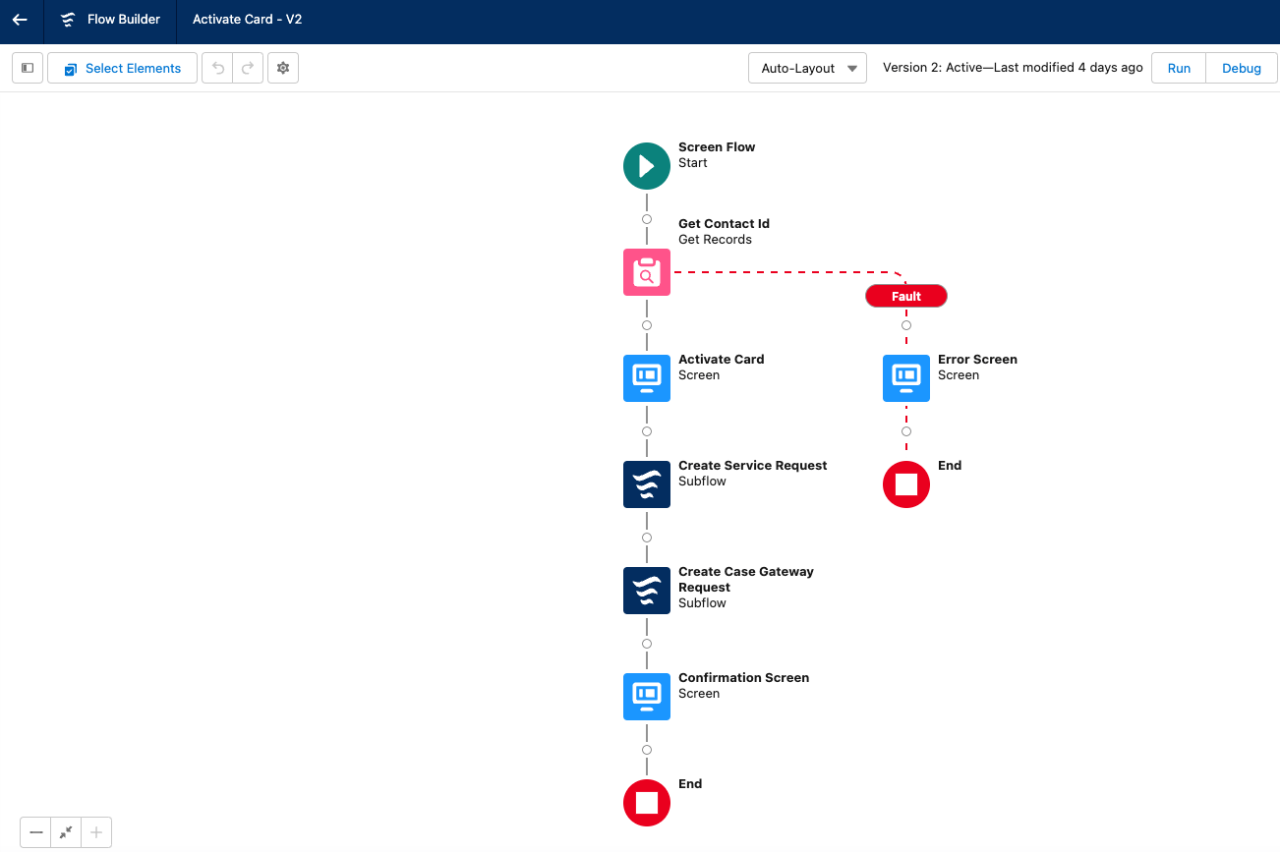

Automation

If your business has multiple complicated processes that must be performed often, automation can save time and reduce human error. Flows are a powerful tool that can provide automated, interactive workflows to perform a process or automate an action behind-the-scenes. Financial Services Cloud comes with plenty of pre-constructed flows for common processes, such as issuing and activating new cards, updating the addresses for a financial account, or collecting a borrower’s financial details. Even with the variety of pre-constructed flows, you can still customize them or construct flows specifically tailored to your business processes.

Flows

If you are wondering if you should use a flow, ask yourself the following questions: Does the task at hand come up frequently? Do you have to perform a lot of repeatable actions like emailing people or updating fields on multiple records? Is the task complex without requiring Apex code? If you answered yes to any of those questions, then flows are your solution.

When building the flow itself, there are many aspects to think about. What data should be presented in a screen flow? When a user updates an object, are there other fields or related objects that should also be updated? What criteria should you use to activate a triggered flow? Does this flow need a user to activate it, or is it better to have the flow run on a schedule? With the right planning and implementation and the use of best practices, flows will ease many tasks in your organization.

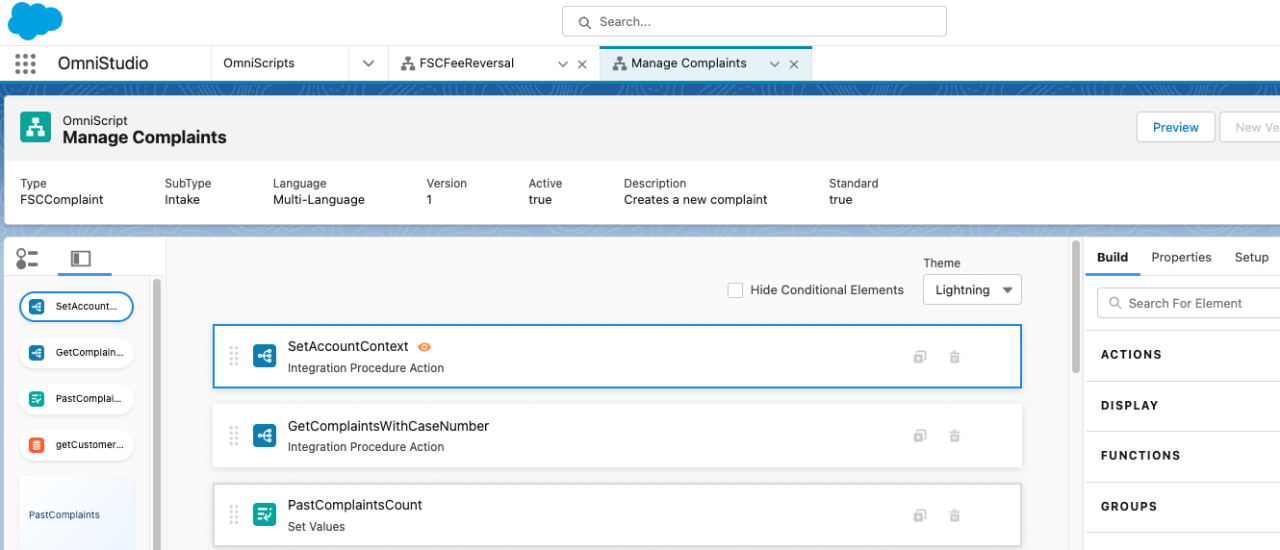

Omnistudio

Omnistudio is another automation tool that simplifies the creation of guided user experiences. Another benefit of Omnistudio is that it can create applications and workflows using data from your Financial Service Cloud and external sources. Features like Flex Cards can contextualize data and give links to related processes, and OmniScripts function very similarly to screen flows. While Financial Service Cloud provides some pre-constructed OmniScripts, such as Fee Reversal or Complaint forms, you can still customize them or create your own OmniScripts.

Since OmniScripts are focused on user experiences, you have to think about what the end user will need to get the most out of it. What data needs to be captured from the customer for your Salesforce org? What data sources, internal or external, do you need to use to better guide a user through an OmniScript process? When you keep those questions in mind, you’ll be able to make things in OmniStudio that gracefully guide your customers through any process that your company offers.

Conclusion

Salesforce Financial Services Cloud offers a wide variety of features to improve your capabilities of supporting your customers. There are many more features that were not discussed, but utilizing the features mentioned above will help you hit the ground running with Salesforce FSC. Please contact DB Services for any questions you have or if you need assistance setting up your Financial Services Cloud.

Need help with your Salesforce digital transformation? Contact us to discuss Salesforce consulting, implementation, development, and support!

Download the Salesforce Financial Services Cloud Implementation Checklist

Please complete the form below to download your FREE Salesforce file.