In the fast-paced business world, efficient payment processing is crucial for maintaining cash flow and providing a seamless customer experience. QuickBooks has long been a go-to solution for managing finances, and integrating it with your web application can elevate the payment processing experience to new heights. In this article, we'll explore the benefits of utilizing QuickBooks' robust payment processing system.

Why use QuickBooks API?

QuickBooks API offers many great benefits. Here are some of the top reasons to consider using QuickBooks API:

Automation: QuickBooks API allows for the automation of various financial and accounting processes. This can save time and reduce manual data entry errors.

Real-Time Data: Access real-time financial data directly from QuickBooks. This is particularly beneficial for businesses that require up-to-date information for decision-making.

Customization: Developers can use the API to build custom solutions tailored to the specific needs of a business. This flexibility allows for the creation of applications that align with unique workflows and requirements.

Streamlined Workflows: By connecting QuickBooks with other tools and applications, businesses can create streamlined workflows. This can lead to improved efficiency and productivity.

Enhanced Security: QuickBooks API adheres to secure authentication protocols, ensuring that sensitive financial data is protected during transmission. This helps maintain the security and integrity of financial information.

Credit Card & Account Tokens

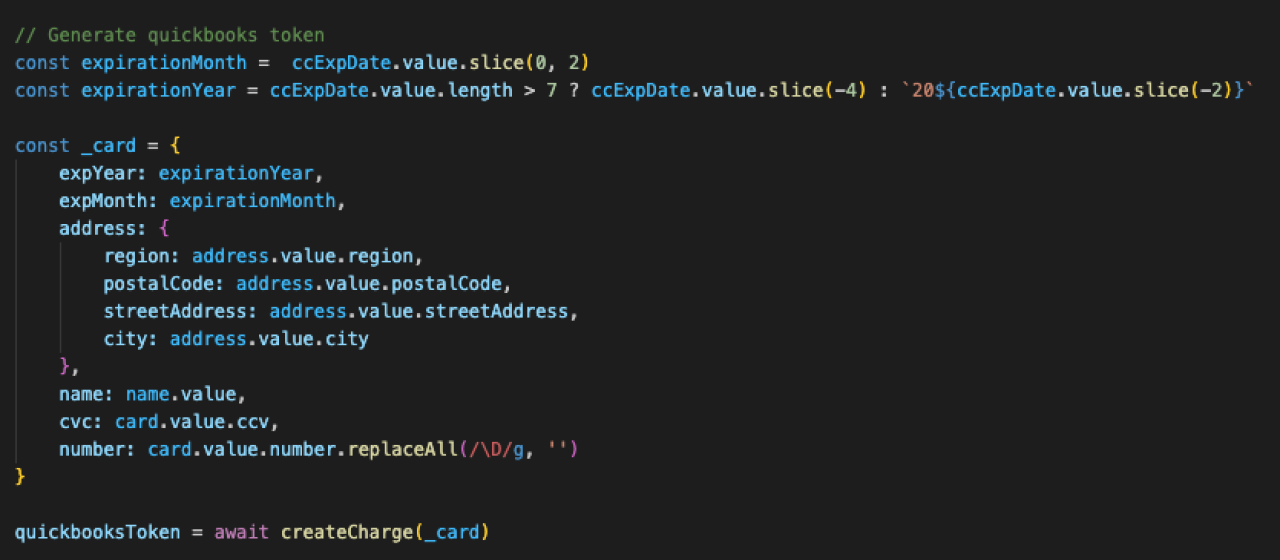

A standout feature of the QuickBooks API is the ability to generate a token representing a credit card or account. This token is then used in future calls, meaning you aren’t sending or exposing any private information. Not only is this great from a security perspective, but it’s also a great start in ensuring your application maintains PCI (Payment Card Industry) compliance.

Payments

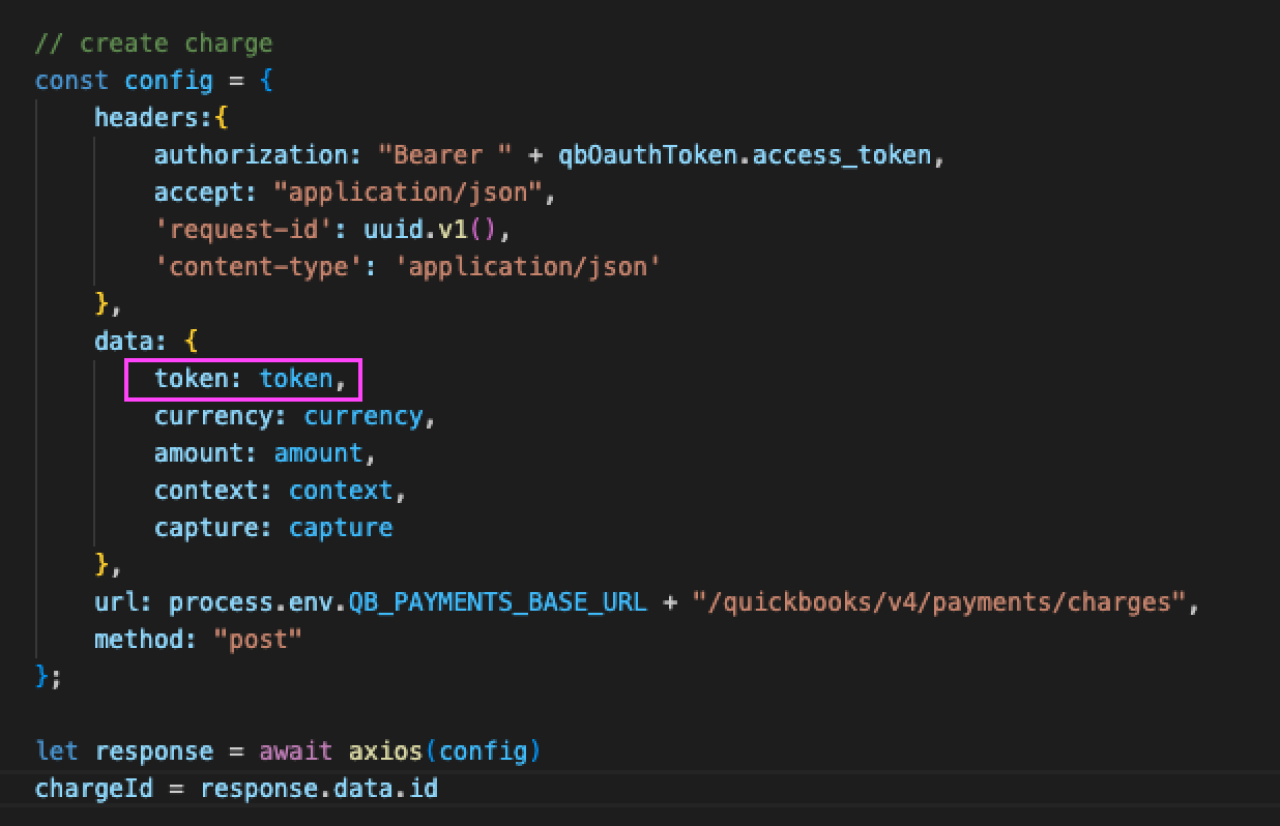

The process of running a payment is done in two steps. First, you'll need to create the charge by providing all the transaction details. The screenshot below highlights where we pass in the token representing the credit card instead of the actual card info.

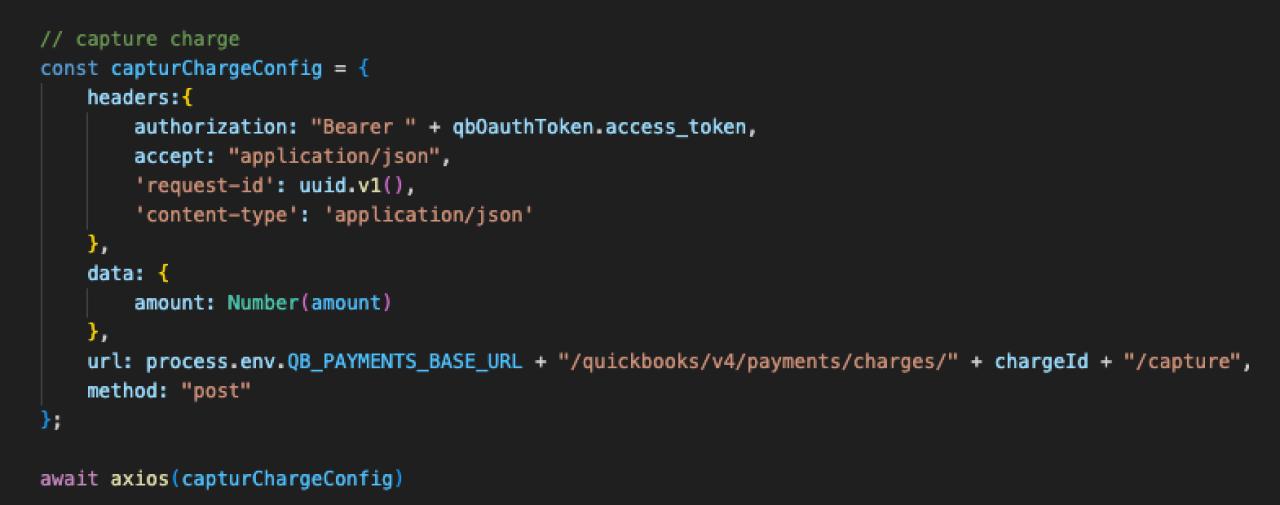

The next step is to capture the charge. This is where the transaction will actually be processed. In the first step, the charge is created and an ID is returned, which we will use in this step to identify the transaction we want to process.

*Note: Each request made to the API requires a unique Request ID. In both the create and capture charge requests, we are passing in a newly created ID.

Sales Receipts

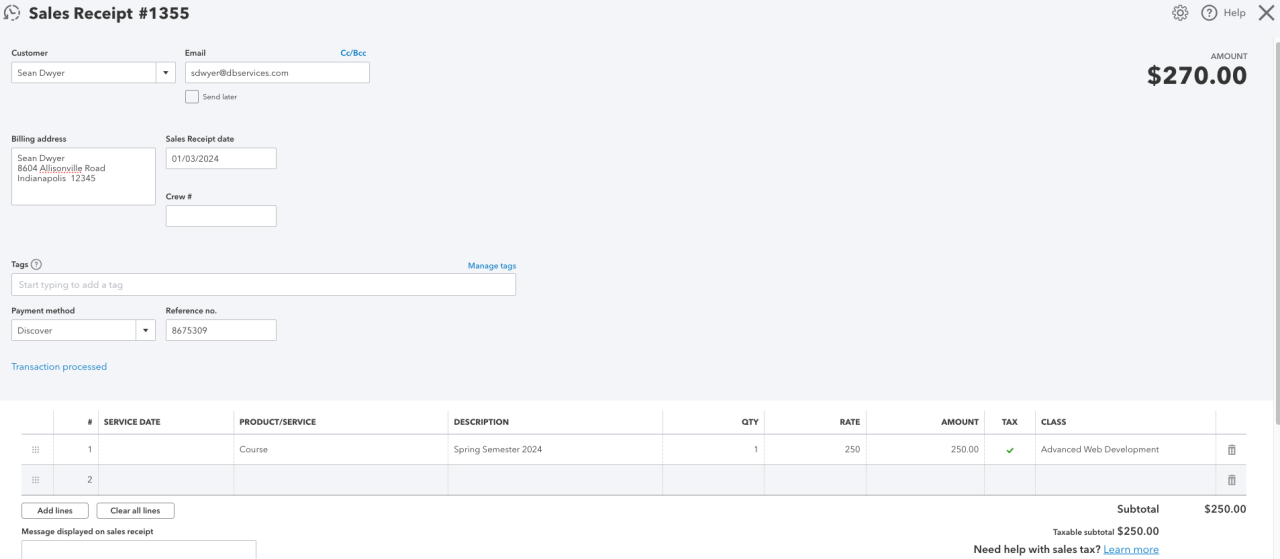

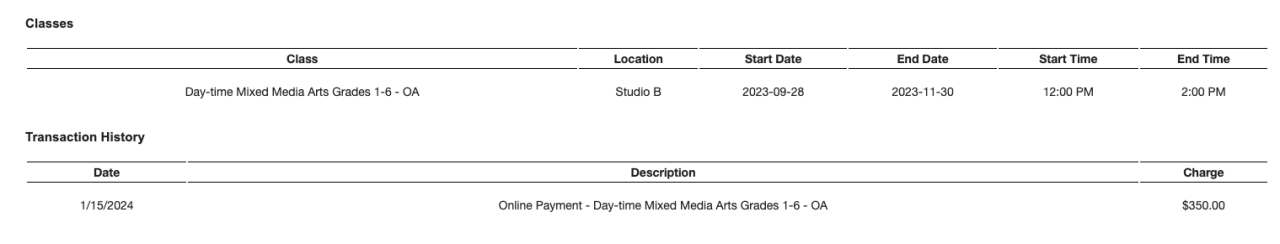

A sales receipt will be created for each transaction within your QuickBooks account. You can view these by logging into your account and viewing all sales.

A custom receipt can also be created and emailed to the customer after a transaction has been processed.

Conclusion

Leveraging the QuickBooks API can result in improved efficiency, better data accuracy, and increased functionality for businesses that rely on QuickBooks for their financial management. If you have any questions or wish to discuss integrating QuickBooks API with your application, please contact DB Services.

Did you know we are an authorized reseller for Claris FileMaker Licensing?

Contact us to discuss upgrading your Claris FileMaker software.